Judul : How can man, my RM4 billion income not taxable one...

link : How can man, my RM4 billion income not taxable one...

How can man, my RM4 billion income not taxable one...

Tax Evasion And Not Money Laundering,

Will Send Him Early To Bamboo River...

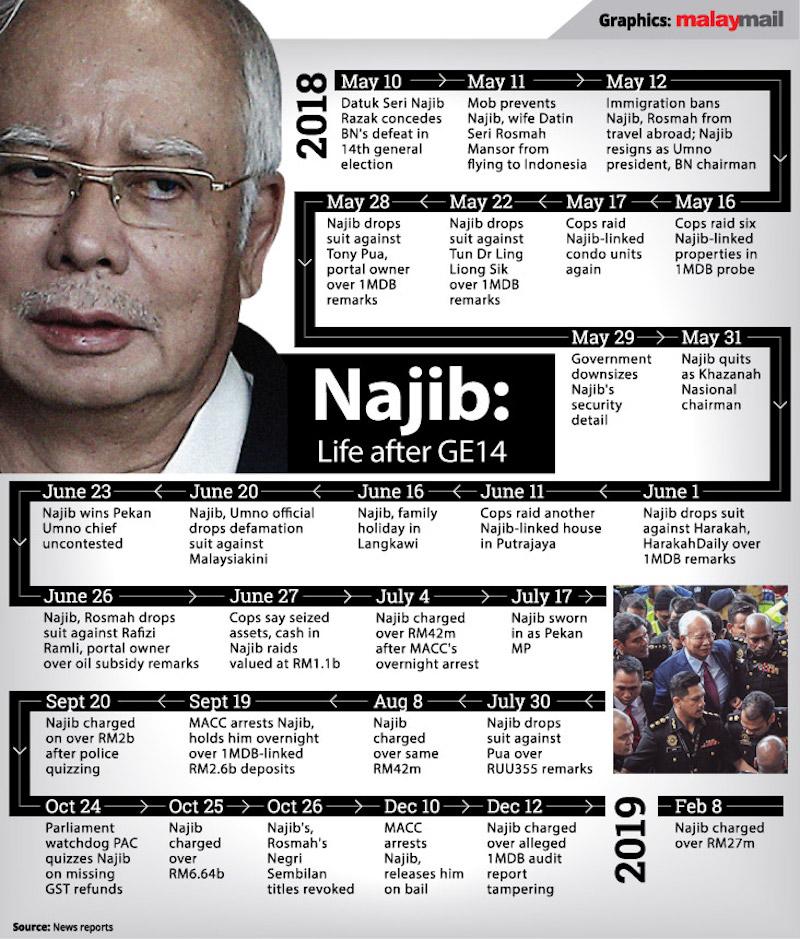

Najib Razak, the former Prime Minister of Malaysia, is terribly upset today. And it’s not hard to understand why. Already slapped with record 42 charges of criminal breach of trust (CBT), money laundering and abuse of power, he is now being asked to settle a huge bill – RM1.5 billion in unpaid taxes – the biggest income tax bill ever sent to an individual in the country, and perhaps in Asia.

While his alleged crime of embezzlement might take years of trials before he could be put behind bars, if convicted, his tax evasion is a different animal altogether. Unlike corruption or money laundering, tax evasion is a pretty straight forward case which does not need truckloads of witnesses or miles of paper trails. It’s a simple question of whether he had declared and paid income taxes or not.

Actually, Mahathir had long questioned Najib whether he had paid taxes on the US$681 million (RM2.6 billion) cash found in his bank accounts, even during the time when Najib was still the powerful prime minister who walked the corridors of power. Yes, as early as 2015, mentor-turned-nemesis Mahathir had dropped the hint that any excess funds must be declared for tax purposes.

Did Najib care? Nope, the arrogant son of the Razak didn’t give a damn about covering his tracks, not that he could. He thought he was invincible as his regime could not be toppled. After all, his government – Barisan Nasional – had ruled for the last 61 years since the independence in 1957. If he had taken care of his income tax, chances are he would have had fled like Thailand ex-PM Thaksin.

The fact that Najib Razak was dazzled and disoriented on the night of May 9, 2018, showed that he and his disgraced wife, Rosmah Mansor, were so confident of winning the 14th general election that a defeat had never crossed their minds. In the same breath, he probably had not read how American notorious gangster Al-Capone was brought down in 1932.

Assistant Attorney General Mabel Walker Willebrandt was the one who recognized that mob figures publicly led lavish lifestyles, yet never filed tax returns, and thus could be convicted of tax evasion without requiring hard evidence to get a testimony about their other crimes. The U.S. Internal Revenue Service then assigned Frank J. Wilson, the Chief of the U.S. Secret Service, to investigate Al-Capone.

The Chicago mobster was practically untouchable by the U.S. authorities for years. However, on June 16, 1931, Al Capone pled guilty to tax evasion, only to make a U-turn. But by October 18, 1931, he was convicted after trial and on November 24, was sentenced to 11 years in federal prison, and fined US$50,000 in addition to US$215,000 plus interest due on back taxes.

Similarly, Najib Razak will be charged for “tax evasion”. There’s a difference between tax evasion and tax avoidance. While tax avoidance is the legal use of tax laws to reduce one’s tax burden, tax evasion is the illegal evasion of taxes by individuals, corporations, and trusts who deliberately misrepresenting the true state of their affairs to the tax authorities to reduce their tax liability.

In the case of Najib, the Inland Revenue Board (IRB) has slapped him with a tax bill for an extra RM1.5 billion of undeclared taxable income of close to RM4 billion between 2011 and 2017, including the RM2.6 billion (US$681 million) “donation” that he has claimed was a donation received from Saudi Arabia royal family, a claim that could not be fully substantiated.

This means that while Najib had paid his income tax for his salary of RM 22,826.65 per month as the prime minister, he had deliberately omitted about RM4 billion of income he received between 2011 and 2017. Interestingly, the crook does not dispute the billion Ringgit figures, suggesting that he agrees that the RM4 billion was indeed deposited into his bank accounts.

What Najib is disputing and disagrees is the basis of calculation and definition of income. Najib argues – “Firstly, political contribution, including from the Saudi Arabia Ministry of Finance is not subject to tax under the law. Secondly, as is publicly known, incomes obtained from abroad are not taxable under taxation laws.”

So, the argument here is not about the RM4 billion, but whether the huge amount of cash was donations or income. Amusingly, Najib’s own arguments were full of contradictions. First, he said political contributions are not taxable. Assuming he meant donations in this context, he has to prove that the RM4 billion in his accounts were actually political donations.

Najib - World Biggest Kleptocrat

The problem is he does not possess all the necessary documents to substantiate his claims. That probably explains why he did not declare the so-called RM4 billion in his tax return for the 7 years, even if he wanted to. He had no choice but decided not to bother about declaring it as no authorities, let alone the Inland Revenue Board (IRB), would dare investigate him.

Second, he said incomes obtained from abroad are not taxable. So, can be make up his mind whether the RM4 billion in his bank account was actually donations or incomes from abroad? True, Malaysia practices the territorial system of taxation. Under Section 3 of the Income Tax Act 1967, only income that is accruing in or derived from Malaysia is subject to tax.

This also means the income derived from outside Malaysia and remitted to Malaysia would be exempted from tax. However, the definition of “income” here means the money received for work done or through investments – certainly not donations. For example, a Malaysian who remits profits from his investment in the U.S. stock market will be exempted from tax.

By definition, it’s also a public knowledge that income is money earned on a regular basis. That’s why it’s called income-tax, and not donation-tax, as far as the Inland Revenue Board (IRB) is concerned. So, did Najib receive donations regularly from the Saudi royal family? If he did not, then he can’t say his RM4 billion was income from abroad. At most, he can say it was donations.

But if it was donations and not incomes, then the question will go back to whether he has the documents in the first place to prove that the RM4 billion was indeed donations from Saudi Arabia or whoever crazy enough to gift him with so much money without strings attached. Perhaps Najib can try to spin and twist that he had “assumed” it was a donation, therefore, he had also “assumed” it was not subject to tax.

Najib Razak - Not Fairlah cam ni...

Fine, let’s assume the Inland Revenue Board (IRB) will be kind enough to accept his ignorance and explanation that he had mistaken the RM4 billion incomes as a donation. And since the IRB is willing to close one-eye about his tax evasion attempt, there’s only one way out – Najib has to pay the damn RM1.5 billion income-tax!

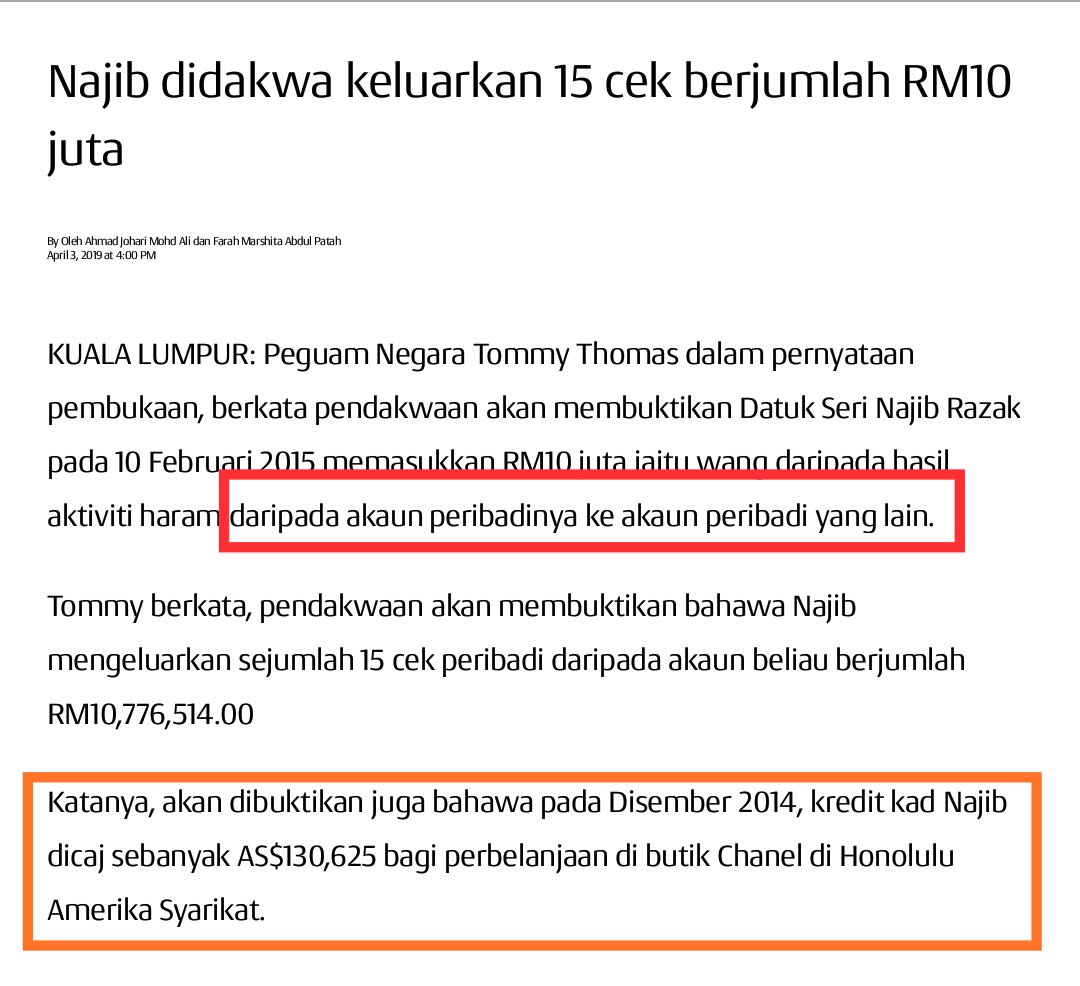

Wait a minute, how did the former Thief-in-Chief earned close to RM4 billion in the first place? Between opening his account at local bank AmBank on January 13, 2011 and April 10, 2013, Mr. Najib received a total of approximately US$1,050,795,451.58 – including a series of individual deposits that ranged between US$9 million and US$70 million.

Depending on the date of foreign exchange rate, that US$1 billion would translate to close to RM4 billion. It’s also known within the AmBank that the former PM Najib Razak’s account was held under the Codename “Mr X”. Najib’s Platinum Mastercard and Platinum Visa issued by AmBank had also been overdrawn thanks to a RM3,320,670.65 purchase of jewellery in September 2014.

Sure, Najib will most definitely cry, moan and bitch that he had returned a bulk of the RM2.6 billion donations to Tanore Finance Corp in Singapore. But it’s also true that the money returned was later recycled and ended up in the purchase of a 22-carat pink diamond necklace – worth a stunning US$27.3 million – for Najib’s despicable wife, Rosmah Mansor.

According to U.S.-DOJ investigations, Najib’s partner-in-crime Jho Low had arranged for jewellery designer Lorraine Schwartz (also known as “Jewish Queen of Oscar Bling”) for the pink diamond on June 2, 2013. In fact, the U.S.-DOJ possessed the conversation of the purchase involving Lorraine Schwartz, Rosmah Mansor and Jho Low – evidence that it was purchased using money stolen from 1MDB.

Clearly, tax evasion is a powerful weapon to skin fat cats with tons of dirty money like Najib Razak and his minions. The crook should have had smelt the taxmen coming months ago after his hotshot crooked lawyer, Shafee Abdullah, was slapped with charges of tax evasion last September. Crooks, by default, would never declare their income tax on ill-gotten incomes. - FT

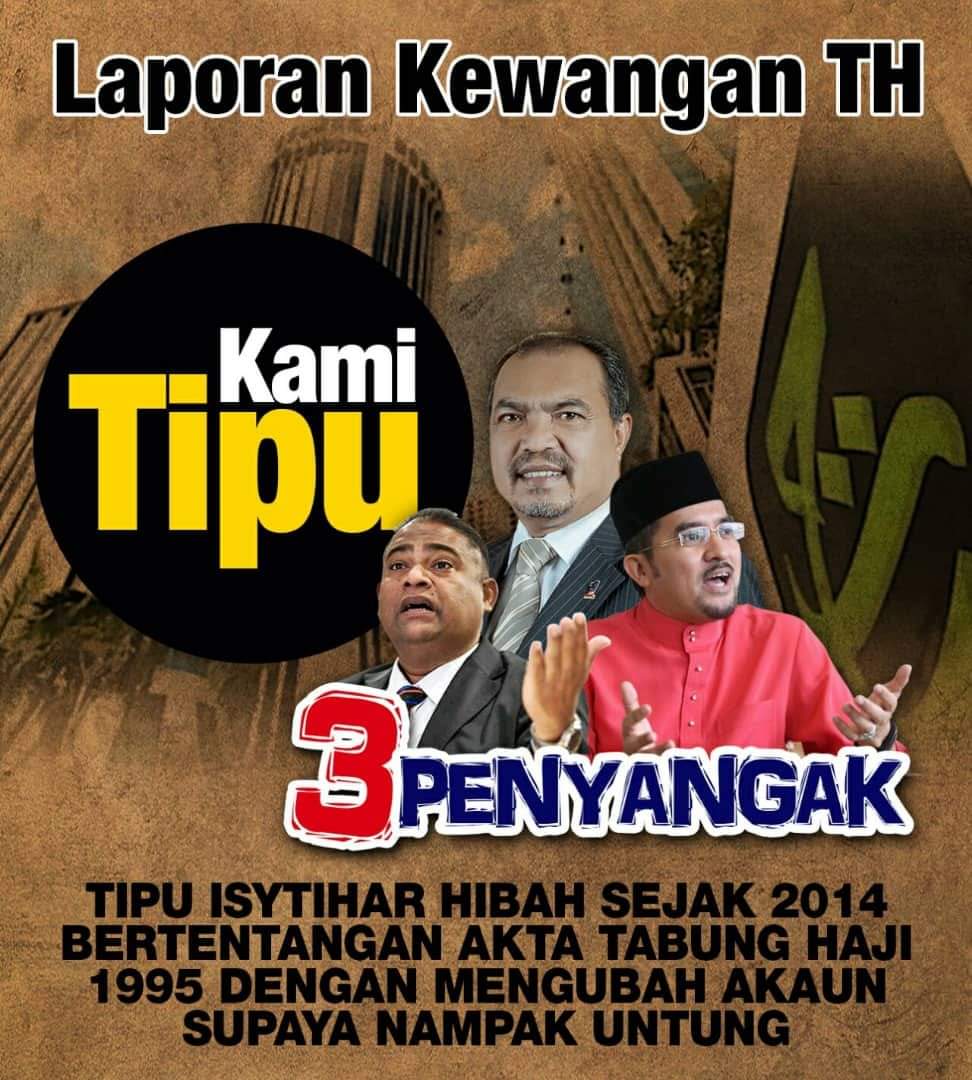

Sembunyikan kerugian LTH sebanyak RM4.1 bilion kerana nak menunjukkan pengurusan nampaknya cantik.. 2 orang agamawan ni tertipu, atau ditipu dengan mamak Baling..

Tabung Haji-Pagar yang

tak boleh diharapkan...

1. ' Harapkan Pegar, Pegar Makan Padi ' - itulah yang berlaku di Tabung Haji atau TH.

2. Sejarah penubuhan TH ini bermula 2 tahun selepas Merdeka.

3. Pada tahun 1959 Profesor DiRaja Ungku Aziz Ungku Hamid dari Universiti Malaya telah mengemukakan satu kertas kerja bertajuk 'Rancangan Membaiki Keadaan Ekonomi Bakal - Bakal Haji’.

4. Tujuannya bagi meyakinkan Umat Islam mengerjakan Fardhu Haji bebas dari riba atau faedah bank.

5. Melalui kertas kerja itu beliau telah mencadangkan penubuhan satu badan bagi mengendalikan urusan haji.

6. Bertolak dari cadangan itu maka sebuah perbadanan yang diberi nama 'Perbadanan Wang Simpanan Bakal - Bakal Haji' ditubuhkan.

7. Pada tahun 1969 atas cadangan Tun Abdul Razak Perbadanan tersebut digabungkan dengan Jabatan Hal Ehwal Haji dan namanya bertukar menjadi Lembaga Urusan dan Tabung Haji atau LUTH.

Jabatan Audit Negara menunjukkan ada defisit sebanyak 4.1 bilion. salah satu sebab adanya defisit ialah sebab memberi hibah (dividen). PwC dipanggil untuk buat laporan dan dapati pemberian hibah tu melanggar Akta Tabung Haji

8. Mulai 1995 sehingga kini LUTH dikenali sebagai Tabung Haji atau TH.

9. Kini jumlah pencarum mencecah kira - kira 9 juta orang.

10. Dengan jumlah caruman yang begitu besar yang berjaya dikumpulkan, berbagai - bagai pelaburan dilakukan; dari peladangan ke hotel, hartanah, bidang teknologi dan dari dalam negeri hinggalah ke luar negara.

11. Kejayaan TH menjadi kebanggaan Umat Islam / Melayu dan menjadi contoh kepada negara - negara Islam seluruh dunia.

12. Namun disebalik kebanggaan tersebut kita juga dikejutkan dan digemparkan dengan beberapa penipuan dan rompakan yang dilakukan oleh mereka yang telah diberi amanah menjaga dengan baik wang pencarum tersebut.

13. Dari Pengerusi dan Lembaga Pengarah ke Pegawai - Pegawai dan kakitangan, dari budak pejabat ke pemandu kereta, dari yang berjanggut dan berkopiah sehinggalah kepada yang berhijab , SEMUAnya Melayu yang beragama Islam yang bekerja di TH.

14. Tidak kedengaran penipuan dan rompakan besar - besaran berlaku di era Tun Razak, Perdana Menteri ke 2 namun ia berlaku semasa Najib, Perdana Menteri ke 6 yang kebetulan anak Tun Razak sendiri.

Ada pula perbezaan antara media statement dan audited financial accounts.

Angka-angka diubah supaya nampak sedap di mata rakyat.

15. Kerosakan besar - besaran ini berlaku apabila Najib melantik Azeez Rahim, Ahli Parlimen Baling, Kedah sebagai Pengerusi TH yang baru.

16. Sebagai Ketua Putra UMNO Malaysia, Azeez telah berjaya memikat kepercayaan Rosmah dan Najib.

17. Walaupun pernah bertugas sebagai budak tarik kereta dan sebagai tukang kebun tapi oleh kerana ' loyalty' mengatasi yang lain, maka beliau telah diberi peluang menjadi Wakil Rakyat dan Pengerusi TH.

18. Bagi membuktikan ketaatan atau loyaltynya , Azeez akan patuh dan laksanakan apa sahaja yang diarah oleh Rosmah dan Najib termasuklah melibatkan wang caruman TH membeli sebidang tanah di Tun Razak Exchange atau TRX bagi membantu 1MDB membayar faedah.

19. Menjelang Pilihanraya Umum yang lepas, bagi membantu Najib, beliau dengan persetujuan Lembaga Pengarah dan dengan bantuan beberapa orang Pegawai tertentu telah memanipulasi akaun TH bagi memberi pulangan atau dividen tinggi kepada 9 juta orang pencarum dengan kepercayaan mereka akan menyokong UMNO / BN. Perbuatan itu sebenarnya bertentangan dengan undang - undang.

20. Seperti pemimpin - pemimpin UMNO yang lain kini Azeez Rahim atau lebih dikenali dengan panggilan Azeez Mamak sedang menunggu giliran untuk dibicarakan.

21. Diharap Lembaga Pengarah TH yang baru yang telah dilantik oleh Tun Dr. Mahathir, Perdana Menteri TIDAK akan mengulangi pengkhianatan terhadap 9 juta pencarum seperti yang dilakukan sebelum ini.

Lagi best,hangpa tengoklah duit tabung haji dilaburkan kat mana.

Pelaburan yang last sekali tu patut diberi perhatian yang serious,

tapi macai,pak lebai dan walaun2 buat2 tak nampak...

23. RCI ini juga HARUS membetul dan mencadangkan perkara - perkara yang perlu dilaksanakan seperti tangga gaji, faedah - faedah tertentu seperti elaun pemindahan seseorang pegawai dari badan induk iaitu TH kepada mana - mana anak syarikat.

24. RCI juga harus maklumkan secara jelas tentang penjualan aset - aset TH kepada SPV ( Special Purpose Vehicle ) - syarat dan keuntungan kepada TH dan apa perlunya penjualan tersebut dilakukan; begitu juga pencarum ingin tahu apa perlu TH membeli 2 buah hotel di London dan apakah benar berlaku unsur-unsur penipuan dan penyelewengan.

25. Pencarum juga BERHAK mengetahui secara terperinci segala pelaburan TH dan anak-anak syarikatnya, sama ada untung atau rugi; ini termasuk ladang-ladang kelapa sawit dan syarikat berkaitan carigali minyak.

26. Tidak boleh disamakan TH dengan syarikat Tenaga Nasional dan Bank Negara yang memberi gaji dan beberapa faedah lain seperti kesihatan WALAUPUN seseorang itu sudah lama bersara.

27. Dana TH adalah sumbangan pencarum semata-mata yang kemudiannya dilaburkan, justeru segala bentuk kemudahan dan keuntungan perlu dipulangkan kepada pencarum, BUKAN untuk diguna sakan oleh mereka di TH dan anak-anak syarikatnya.

28. Kepada Menteri, Ahli Lembaga Pengarah, Pegawai dan semua kakitangan TH, lakukan yang terbaik kerana kedudukan dan jawatan yang di pegang adalah AMANAH yang pasti akan disoal di Akhirat kelak. - Tamrin Tun Ghafar

The Rakyat vs Najib...

Ketua Kartel penuh misteri...

Demikianlah Artikel How can man, my RM4 billion income not taxable one...

Sekianlah artikel How can man, my RM4 billion income not taxable one... kali ini, mudah-mudahan bisa memberi manfaat untuk anda semua. baiklah, sampai jumpa di postingan artikel lainnya.

Anda sekarang membaca artikel How can man, my RM4 billion income not taxable one... dengan alamat link https://kabarberitamalay.blogspot.com/2019/04/how-can-man-my-rm4-billion-income-not.html